louisiana estate tax return

6 2022 to claim millions of dollars in state income tax refunds before they become unclaimed property. School Readiness Tax Credits.

Louisiana Inheritance Tax Estate Tax And Gift Tax

Under the federal estate tax law there is a credit for state death taxes that are paid up to a certain amount.

. Check the IRS website for where to mail your tax return. But everybody should be aware of the rules. How do I send my tax return by mail.

Generally the estate tax return is due nine months after the date of death. By submitting an extension request you are requesting only an extension of time to file your Louisiana Fiduciary Income Tax return. Completing Form IT-541 Fiduciary Income Tax Return Who Must File a Return Louisiana Revised Statute RS 47162 provides that every resident estate or trust and every nonresident estate or trust deriving income from Louisiana sources is liable.

A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. For other state taxes use Louisiana File Online. Returns and payments are due on May 15th of each year on the preceding years income or on the 15th day.

Louisiana Department of Revenue PO. Just because Louisiana doesnt have an estate tax or inheritance tax doesnt mean youre in the clear as far as the IRS is concerned. But just because Louisiana does not have an estate tax does not mean that the same is true for the federal government.

Every resident estate or trust and every nonresident estate or trust deriving income from Louisiana must. For general information on the filing of consolidated sales tax returns please visit the FAQ and select. Louisiana Estate and Inheritance Tax Return Engagement Letter - 706 To access and download state-specific legal forms subscribe to US Legal Forms.

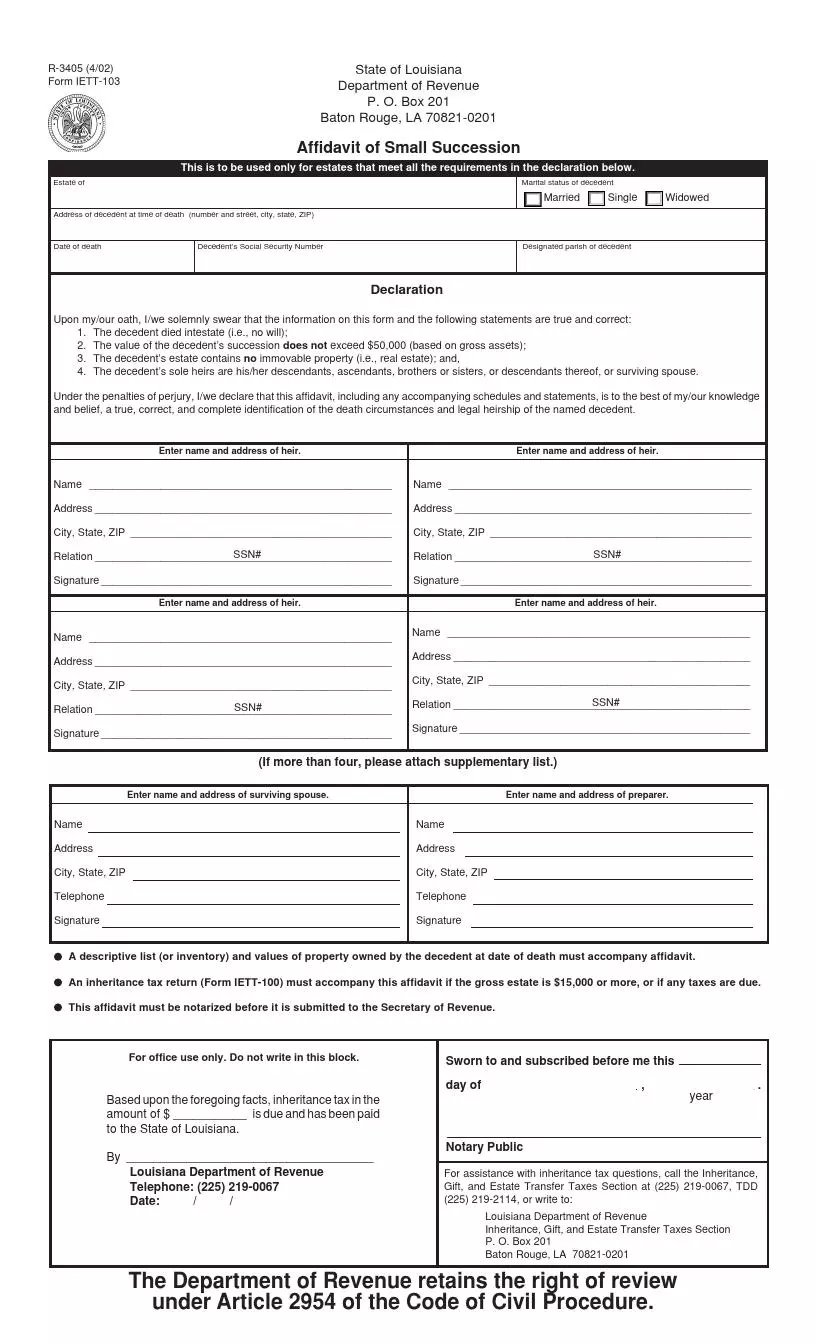

This application will walk you through the process of filing an extension for your taxes. Requirements for Filing Returns Inheritance taxAn inheritance tax return must be prepared and filed for each succession by or on behalf of all the heirs or legatees in every case where inher- itance tax is due or the value of the deceaseds estate is 15000 or more LSA-RS. If you have income tax questions or need technical help while filing your returns online you can call the Louisiana Department of Revenue at 1-855.

Click on View Tax Summary under Other helpful links. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more. Louisiana Citizens Insurance Tax Credit.

Estate transfer taxAn estate transfer tax return must be prepared and filed for each. The Louisiana Department of Revenue manages collection of the states individual income tax as well as other taxes like Louisiana sales tax consumer use tax gift tax and estate transfer taxes. Who must file a return There is imposed an income tax for each taxable year upon the Louisiana taxable income of every estate or trust whether resi-dent or nonresident.

Original return Amended return Partial return Date of originalaaa Real estate Louisiana property only Stocks and bonds Mortgages notes and cash Insurance Other miscellaneous property. BATON ROUGE Louisiana taxpayers have until Oct. The estate would then be given a federal tax credit for the amount of state estate taxes that were paid.

2 create a trust for grandchildren special needs heirs or spendthrift heirs. Does Louisiana Have an Inheritance Tax or Estate Tax. Send to the Correct Address.

Fortunately only 1 or less of total households are required a file an estate tax return. Box 201 Baton Rouge LA 70821-0201 225 219-0067 Inheritance and Estate Transfer Tax Return Mark one. Look for the amount on Line 24.

Click on Tax Tools. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The estate transfer tax is only imposed on estates that are subject to federal estate taxation under the Federal Internal Revenue Code.

Grantor trusts as defined in Louisiana. Box 751 Baton Rouge LA 70821-0751. And 4 name an executor to collect the assets of your estate pay any bills due and distribute your estate to your heirs.

Louisiana Department of Revenue Taxpayer Services Division P. The Louisiana Department of Revenue LDR sent letters to 20400 individual and business taxpayers advising them to claim their refunds before they are transferred by law to the Unclaimed Property Division of the state. Return then Form R-6465 should be filed with the Department by the due date of the return for which the extension applies.

If you are mailing a check for the Louisiana taxes due include the R-2868-V payment voucher along with your payment and mail to. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. Open your return.

Louisiana does not levy an estate tax against its residents. Franchise Tax Partnership Tax Fiduciary Income Tax. Yes Louisiana imposes an estate transfer tax RS.

This request does not grant an extension of time to pay the tax due. Final individual federal and state income tax returns each due by tax day of the year following the individuals death. Fiduciary Income Tax Who Must File.

Once open scroll down to page 2 of your 1040. Click here for parish and state contact information. Payments received after the return due date will be charged interest and late payment penalty.

The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and. The gift tax return is due on April 15th following the year in which the gift is made. The amount of the state estate tax is equal to the federal estate tax credit allowed for state death taxes.

Individual Income Tax Resident Non-Resident Athlete Declaration of Estimated Income Taxes. Simply select the form or package of legal documents to download print and fill out. Individual Income Tax Corporate Income.

Select the tax type for which you want to request a filing extension. Ad Fill Sign Email Form LAT05 More Fillable Forms Register and Subscribe Now. Tutor in Louisiana for minor children.

You are required to have an LDR account number. Click on Preview my 1040. Welcome to Online Extension Filing.

3 make provisions to save estate taxes for larger estates. In fact you may have to file all of the following. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

If none of this is important then you. For other forms in the Form 706 series and for Forms 8892 and 8855 see the related.

Louisiana Succession Taxes Scott Vicknair Law

Louisiana Estate Tax Everything You Need To Know Smartasset

Free Louisiana Small Estate Affidavit Form Pdf Formspal

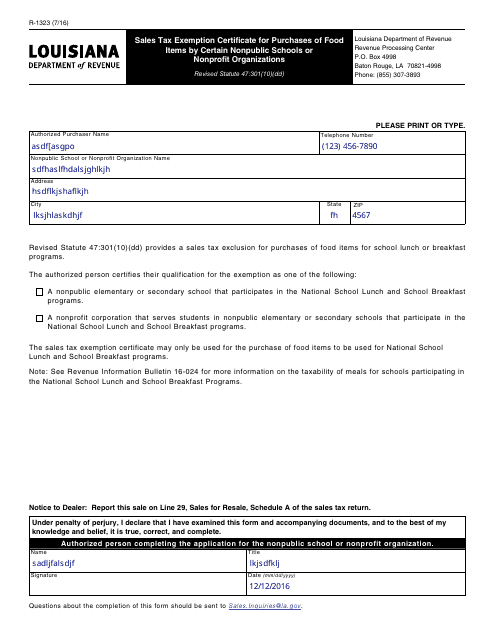

Form R 1323 Download Fillable Pdf Or Fill Online Sales Tax Exemption Certificate For Purchases Of Food Items By Certain Nonpublic Schools Or Nonprofit Organizations Louisiana Templateroller

Louisiana La Property Tax H R Block

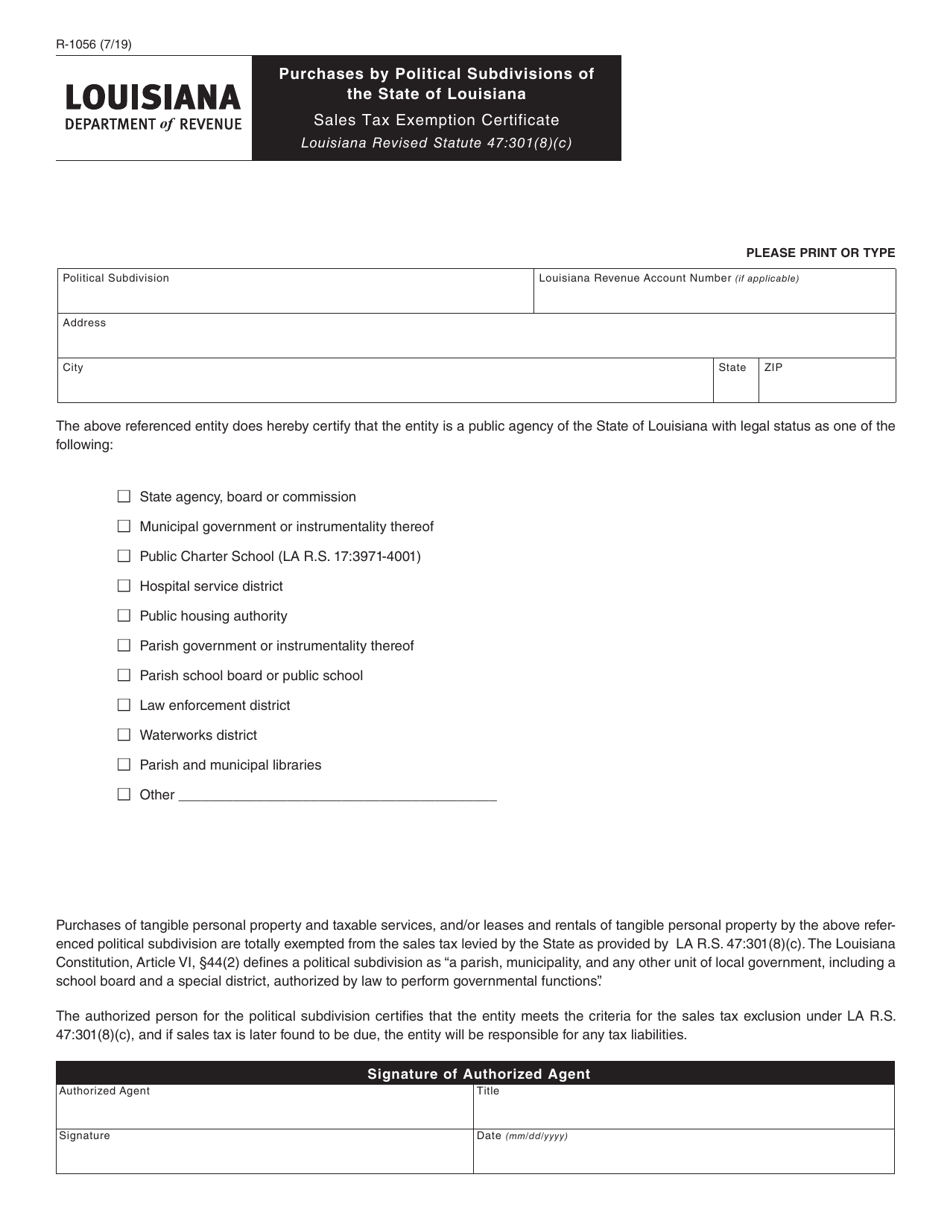

Form R 1056 Download Fillable Pdf Or Fill Online Certificate Of Sales Use Tax Exemption Exclusion Of Purchases By Political Subdivisions Of The State Of Louisiana Louisiana Templateroller

Louisiana Inheritance Tax Estate Tax And Gift Tax

Estate Taxes New Orleans Orleans Parish Louisiana Lawyer Attorney Law Firm

Fillable Online Revenue Louisiana Form R 1058 Louisiana State Tax Fax Email Print Pdffiller

Louisiana Estate Tax Everything You Need To Know Smartasset

Estate Tax Strategies For Business Owners Family Enterprise Usa

The Value Of A Louisiana Succession Estate Scott Vicknair Law

Louisiana Estate Tax Everything You Need To Know Smartasset

Filing Louisiana State Tax Things To Know Credit Karma

Home Page Louisiana Department Of Revenue